virginia tesla tax credit

First the amount you receive will depend upon your vehicles gross weight and battery capacity and your EV must have at least five kilowatt-hours of capacity and use an. Dont forget about federal solar incentives.

Electric Vehicle Buying Guide Kelley Blue Book

1500 tax credit for lease of a new vehicle.

. Property tax exemption on the added home value from the solar equipment. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles. The federal solar tax credit.

You get a 7500 tax credit so that also. Exemption tax value varies by county city or town 6. The credit claimed cant exceed your tax liability.

The 26 federal solar tax credit is available for purchased solar photovoltaic PV systems installed by December 31 2022. Virginia Solar Incentives Rebates and Tax Credits. The federal tax credit falls to 22 at the end of 2022.

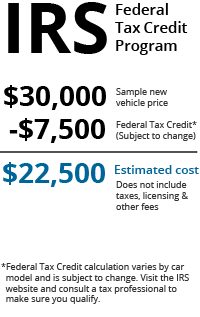

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. If the purchaser of an EV has an income that doesnt exceed 300. The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman principal tax research analyst at HR Blocks.

HB 1979 proposes that an individual who buys or leases a new or used electric motor vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a 2500 rebate. Virginia Governor Ralph Northam has signed a bill which will require car manufacturers to sell a certain percentage of electric or hybrid vehicles. However you should be aware of the following requirements.

This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax. Virginia entices locals to go green by offering numerous time- and money-saving green driver incentivesThese perks include alternative fuel vehicle AFV emissions test exemptions for electric cars and hybrids high occupancy vehicle HOV lane access for clean-fuel vehicles state and federal tax incentives discounted electric vehicle EV charging rates fuel-efficient auto. The legislation will be formally introduced when the Virginia General Assembly convenes on Wednesday January 8 in Richmond.

For the purposes of the rebate program an electric motor vehicle means a motor. As it stands the credit provides up to 7500 in a tax credit when you claim an EV purchase on taxes filed for the year you acquired the vehicle. Select utilities may offer a solar incentive filed on behalf of the customer.

Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. You claim the credit the same year that you create the job then each of the next 4 years so long as the job remains continuously filled. Review the credits below to see what you may be able to deduct from the tax you owe.

HB 717 proposes that an individual who buys or leases a new or used electric vehicle from a dealer in Virginia and registers the vehicle in Virginia would be eligible for a rebate. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. Keep in mind that the ITC applies only to those who buy their PV system outright either with a cash purchase or solar loan and that you must have enough.

A 500 income tax credit for each new green job created. Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates. Used Vehicles Would Qualify.

Carry forward any unused credits for 5 years. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent.

Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. This bill includes electric vehicle tax credits as described below worth up to 12500 for electric vehicles built by unionized workers while Tesla would be eligible for a tax credit of 8000 in the home version or 10000 in the Senate version. 2500 tax credit for purchase of a new vehicle.

Retiree Andy Roberts displays a photo of his daughter 5-year-old Tesla at his home Thursday Jan. On July 29 Senator Diane Feinstein introduced legislation that provides a 2500 tax credit. 11th 2021 622 am PT.

13 2022 in St. The Virginia General Assembly approved HB 1979 which provides a 2500 rebate for the purchase of a new or used electric vehicle. The MSRP for new vehicles and.

An additional 2000 rebate would be available for certain income qualified individuals. This is 26 off the entire cost of the system including equipment labor and permitting. If your solar energy system costs 20000 your federal solar tax credit would be 20000 x 26 5200.

You can claim a credit for up to 350 new jobs. Tesla and GM are set to.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Updated 17 States Now Charge Fees For Electric Vehicles Greentech Media

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News

A Breakdown Of The Us Ev Market By State Shows More Incentives Equals More Sales Jato

Electric Vehicle Sales Enjoy Boost In Areas Of Minnesota Twin Cities

Ev Tax Credit Plan Draws Ire From Nonunion Toyota Tesla Transport Topics

Inside Clean Energy Electric Vehicles Are Having A Banner Year Here Are The Numbers Inside Climate News

Tesla S Fremont Car Plant Was Most Productive In North America In 2021 Report